As the Dow passed 14K and the view is turning towards the belief that the financial crisis is over, the logical conclusion is that we are seeing the birth of a new secular bull. Indeed, I examined the kurtosis of stock returns and found that it is falling.

Tails are getting thinner

For non-geeks,

kurtosis is the measure of how fat the tails are in a return distribution. There are different kinds of fatness, as shown in the diagram below. Here is one explanation:

[W]ait till you hear two more terms: leptokurtic and platykurtic. These describe two different distributions, all part of what is known as kurtosis, the measure of the combined weight of the tails of a distribution in relation to the rest of it. When tails become heavier, the kurtosis value increases; when they are lighter, it decreases. A normal distribution has a kurtosis of 0, and is called mesokurtic (A below). If a distribution is peaked (tall and skinny), its kurtosis value is greater than 0 and it is said to be leptokurtic (No ointments needed.) (B below). If, on the other hand, the kurtosis is flat, its value is less than 0, or platykurtic (C below).

When kurtosis is 0, it is an indication that a distribution is normally distributed (like diagram A). The higher the kurtosis, the fatter the tails. To give a better real-life interpretation of this measure: A risk-manager at a hedge fund explained to me that once the kurtosis of an investment strategy gets above 2 or 3, he starts to get concerned about unusual fat-tailed events.

The chart below shows the trailing one (blue line) and four year (red line) kurtosis of daily SPX returns. We see periods where tails have gotten fatter (Lehman in 2008, Eurogeddon fears in 2011). Overall, four-year trailing kurtosis has been falling since the Lehman Crisis of 2008. In fact, one-year trailing kurtosis is at the lowest level since the Lehman Crisis.

If it were to fall further, it is a signal that the market believes that this is a new era - and perhaps an indication that this is the start of a new secular bull market in equities.

Ray Dalio turns bullish

Certainly, there are some well-known advocates for a new secular bull. Ray Dalio of Bridgewater Associates recently hinted at a New Era (via

Business Insider):

Dalio says 2013 is likely to be a transition year, where large amounts of cash will move to stock and all sorts of stuff – goods, services, and financial assets. People will spend more with the cash, they will invest in equities and gold – the cash will move.

This comment is consistent with his view that the US is undergoing a "beautiful deleveraging" (see my previous post

A Dalio explanation of the Evans-Pritchard dilemma) where he explained his views in a

Barron's interview:

Barron's: You've called the current phase of the U.S. deleveraging experience "beautiful." Explain that, please.

Dalio: Deleveragings occur in a mechanical way that is important to understand. There are three ways to deleverage. We hear a lot about austerity. In other words, pull in your belt, spend less, and reduce debt. But austerity causes less spending and, because when you spend less, somebody earns less, it causes the contraction to feed on itself. Austerity causes more problems. It is deflationary and it is negative for growth.

Restructuring the debt means creditors get paid less or get paid over a longer time frame or at a lower interest rate; somehow a contract is broken in a way that reduces debt. But debt restructurings also are deflationary and negative for growth. One man's debts are another man's assets, and when debts are written down to relieve the debtor of the burden, it has a negative effect on wealth. That causes credit to decline.

Printing money typically happens when interest rates are close to zero, because you can't lower interest rates any more. Central banks create money, essentially, and buy the assets that put money in the system for a quantitative easing or debt monetization. Unlike the first two options, this is an inflationary action and stimulative to the economy.

Barron's: How is any of this "beautiful?"

Dalio: A beautiful deleveraging balances the three options. In other words, there is a certain amount of austerity, there is a certain amount of debt restructuring, and there is a certain amount of printing of money. When done in the right mix, it isn't dramatic. It doesn't produce too much deflation or too much depression. There is slow growth, but it is positive slow growth. At the same time, ratios of debt-to-incomes go down. That's a beautiful deleveraging.

We're in a phase now in the U.S. which is very much like the 1933-37 period, in which there is positive growth around a slow-growth trend. The Federal Reserve will do another quantitative easing if the economy turns down again, for the purpose of alleviating debt and putting money into the hands of people.

We will also need fiscal stimulation by the government, which of course, is very classic. Governments have to spend more when sales and tax revenue go down and as unemployment and other social benefits kick in and there is a redistribution of wealth. That's why there is going to be more taxation on the wealthy and more social tension. A deleveraging is not an easy time. But when you are approaching balance again, that's a good thing.

In this week's of

John Mauldin's Outside the Box column, Christian Menegatti and David Nowakowski of Roubini Global Economics (!) argue that the household delveraging process is well underway and they can see the light at the end of the tunnel:

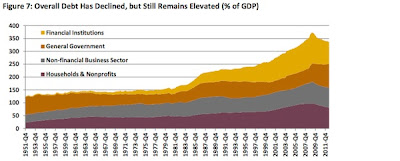

Household balance sheet repair is virtually complete:

...though much of the debt has shifted to the government's balance sheet and the financial services sector is still undergoing a deleveraging process.

They remain constructive for the outlook for the American economy, though the healing process is not complete:

[D]eleveraging on the private side of the economy has been the flip side of the large government deficits. (In fact, the urge to save and the need to default—rather than stimulus—is the main cause of the sustained slump that is in turn the main cause of the reduced revenues and thus the fiscal deficits.) Figure 6 suggests that, compared with the post-World War II trend of rising household indebtedness, the recent debt reduction is already enough. But there is no financial or economic argument for this trend being the right long- term equilibrium. If wealth and income levels are back to mid-1990 levels, and economic uncertainty at 1970-90 levels, then household indebtedness might be more appropriate at 65% of GDP or even 50% of GDP. Even if the current pace of GDP growth combined with defaults and savings continues, it would take until 2016 or 2019 to reach those levels once more.

My problem with the New Era thesis

Here's my problem with the New Era thesis

: Dalio runs a hedge fund that is global in scope. While I accept his view that we are seeing the light at the end of the tunnel for the United States, the US isn't the only country in the world and there are other major trading blocs on this earth. I understand Dalio's explanation (via

Josh Brown) that there is too much liquidity sloshing around and, with tail risk off the table, cash should come back into equities. However, any rally from such a re-allocation for technical, rather than fundamental reasons, and it is not sustainable longer term, i.e. for investors with a five year horizon.

Macro risk not completely eliminated

Dalio has also said that, in connection with his "beautiful deleveraging" thesis, that Europe has its policies all wrong and certain to see further eurozone crisis down the road. What's more, China is still in the credit expansion phase of its growth and has yet to even begin its deleveraging process, which would be triggered by a realization that it has too much capacity (i.e., too many see-through buildings) supported by too much debt.

Simply put, the global deleveraging process is not over!

Can we truly have a New Era bull market under those circumstances? Even if the US economy were to start growing at 2-3% real rate, what are the transmission linkages in the global financial system? If Europe were to lurch into another crisis over, say Cyprus, over the summer, can we be assured that a large European bank like Societe Generale won't go down over bad loans and do severe damage to the American financial system? While it is true that the ECB is winning the battle against the tail-risk of a sovereign debt crisis, they have yet to win the peace as there is little prospect of growth on the horizon. In this

Project Syndicate article, Eric Labaye of the McKinsey Global Institute asks, in effect, where is the private investment in Europe? Corporate balance sheets are stuffed full of cash, but they don't seem confident enough to invest. If private capital isn't confident enough to invest in Europe, where will growth come from?

What's more,

Bruce Krasting pointed out that the EURJPY exchange rate is skyrocketing. For a export sensitive economy like Germany, this has to hurt and will be a growth headwind for the engine of the eurozone.

What about China? What if China were to blow up in the next few years (see my recent post

Is Chinese re-balancing bullish?), that a great big gaping hole won't appear in the balance sheet of a major bank like Citi, Deutsche, or HSBC? (

Disclaimer: This is just speculation as I know nothing specific about any of the aforementioned banks.)

The other issue I have with the belief that we are witnessing the start of a new secular bull is valuation. Historically, stock market valuations tend to get highly depressed at the start of a new secular bull market. The chart below (via

VectorGrader) depicts market cap to GDP, as a simple proxy for the aggregate Price to Sales ratio for the stock market. Note that when this ratio is falling, it coincides with a range-bound stock market.

If you were charitable, you could argue that stocks got to fair value before rising and market cap to GDP is at above average valuations compared to its own history. Maybe this is indeed a New Era, but secular bulls generally don't behave this way.

The best explanation I have is that the current bull is a cyclical upswing and not a secular one. This analysis suggests that we are still in a range-bound market. Stocks could go higher from these levels, but don't expect them to rocket to sustainable new highs in the next 12-36 months.

Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.